is there a state estate tax in florida

No estate tax or inheritance tax. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of.

Florida Inheritance Tax Beginner S Guide Alper Law

Federal Estate Tax.

. No estate tax or inheritance tax. Florida also does not assess an estate tax or an inheritance tax. Florida Real Estate Taxes and Their Implications.

The top estate tax rate is 16 percent exemption threshold. No estate tax or inheritance tax. Previously federal law allowed a credit for state death taxes on the federal estate tax return.

The state income tax in Florida doesnt apply to Social Security benefits pensions or other sources of income including IRAs 401ks or corporate retirement plans. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

It also has no inheritance tax or estate tax. However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40.

Florida Does Not Have an Estate Tax But The Federal Government Does Fifteen states levy an estate tax. A federal change eliminated Floridas estate tax after December 31 2004. The pro rata portion of the estate tax due Florida is determined by the following formula.

What You Need to Know. If a nonresident decedent owned Florida property a pro rata portion of the credit for state death taxes see Part II Florida Form F-706 is due to Florida. But if you do make money from renting or when you sell your property there will be Federal taxes to the US government to pay on the profit.

Estate and Inheritance Taxes There are no death taxes otherwise known as inheritance taxes in Florida on the value of estates or inheritances. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. There is no estate tax in Florida and the property and sales tax rates are substantially lower than those in.

Florida is one of those states that has neither an inheritance tax nor a state estate tax. If you have to pay capital gains taxes those will be due at filing. However federal estate taxes may still be due depending on the value of the gross estateThe gross estate includes trust assets assets held in the decedents name jointly held property accounts designating a beneficiary life insurance annuities etc.

13 rows There is no estate tax in Florida. According to the state homeowners in Florida pay an average of 1752 in real property taxes per year though the amount varies greatly from county to county. If youve inherited property from someone you wont have to pay the federal estate tax however.

In general one is averaged. That means no state taxes on Social Security benefits pensions IRAs 401ks and other retirement income. Estate taxes are paid by the decedents estate before assets are distributed to heirs and are thus imposed on the overall value of the estate.

Floridians no longer need to pay taxes to the state on intangible goods such as investments. There is also an average of 105 percent local tax added onto transactions giving the. Gross Value of FL Property 1 X Federal Credit for State Death Taxes from Form 7062 Florida Estate Tax Gross Value of Entire Estate or 3.

The federal government does have an estate tax that applies to all US citizens. No portion of what is willed to an individual goes to the state. Essentially what happened was if an estate was large enough to be subject to the Federal Estate Tax Florida would tax that estate as well.

Who Has to Pay Federal Estate Taxes. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. These are all costs that are important to consider and understand before buying or selling a home in Florida.

The state constitution prohibits such a tax though Floridians still have to pay federal income taxes. Rate is 98 compared to 98 in Italy. In Florida there is no state income tax as there is in other US states.

Moreover Florida does not have a state estate tax. Inheritance taxes are remitted by the recipient of a bequest and are thus based on the amount distributed to each beneficiary. Real estate transactions are subject to federal and state taxes as well such as the capital gains tax mentioned above.

The federal government then changed the credit to a deduction for state estate taxes. Florida one of our 10 most tax-friendly states for retirees has no state income tax. No estate tax or inheritance tax.

In 1926 the federal government began offering a generous federal credit for state estate taxes. Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. Florida does not collect an estate tax.

First Florida has no separate estate tax. However federal IRS laws require an estate tax. However it would not increase the total estate tax liability as the Federal estate tax would.

In Florida there are no state taxes related to inheritance and the estates of those who have died. Florida does not have an estate tax. The states constitution prohibits it.

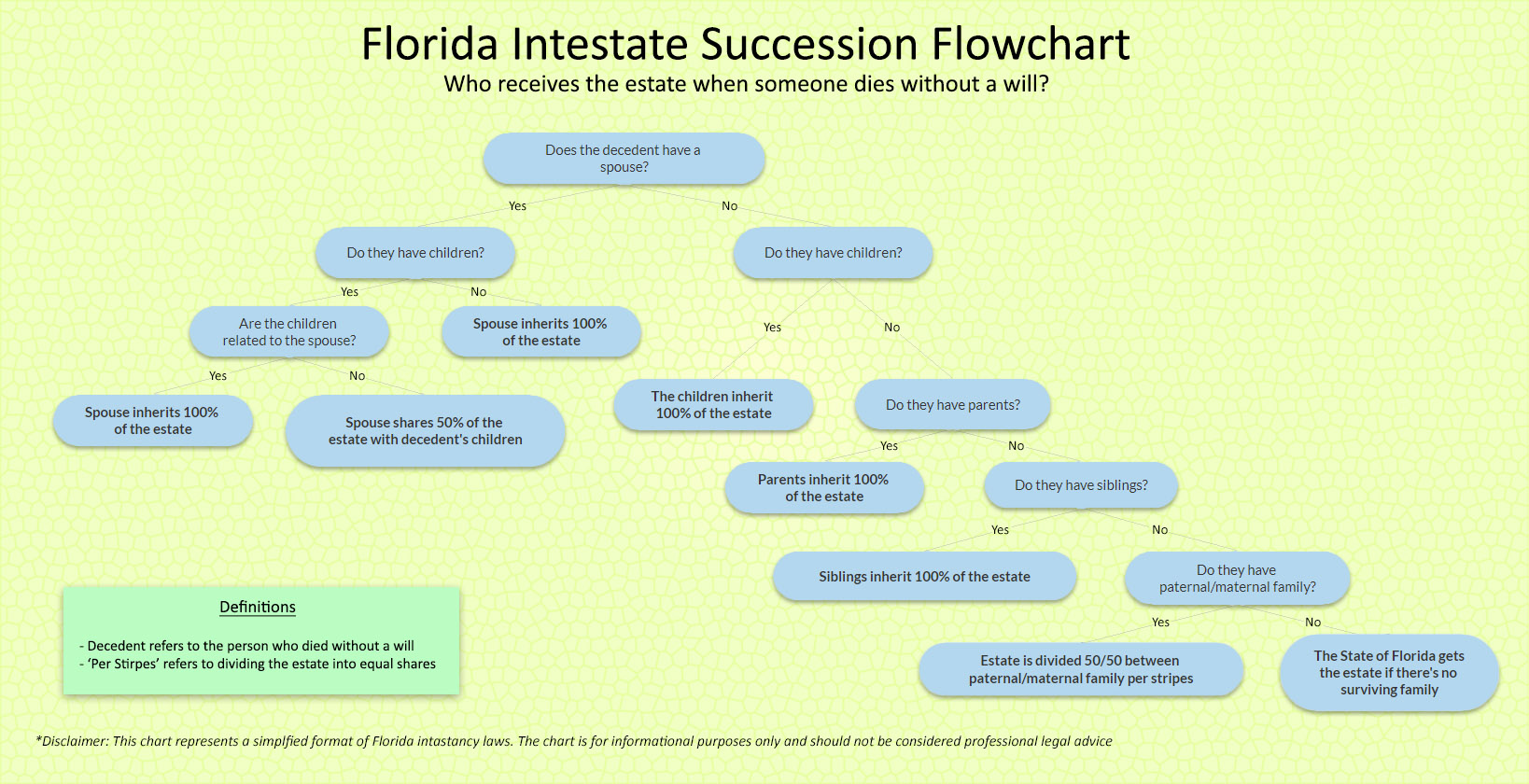

Remember that heirs only receive whats left of an estate after the decedents debts are paid off. The state abolished its estate tax in 2004. Florida has a sales tax rate of 6 percent.

The Florida estate tax was repealed effective Dec. 31 2004 and it cannot be reinstated. Florida did have what is commonly known as a sponge tax which is tied to the Federal Estate Tax.

The good news is Florida does not have a separate state inheritance tax. This lack of inheritance tax combined with the absence of Florida income tax makes Florida attractive for wealthy. In many parts of the world it is common to pay taxes in some form.

The top estate tax rate is 16 percent exemption threshold. Below youll find detailed information about how the state handles its residents estates both when theres a will present and not. There is no real property tax rate in Florida which averages out to zero.

An estate tax is a tax on a deceased persons assets after death. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as.

Ed Ogden Thiensville Sale In 2022 State Of Florida Germantown Testimonials

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Vs South Carolina For Retirement Which Is Better 2020 Aging Greatly

Update Fluvanna County Supervisors Approve Real Estate Tax Increase Estate Tax Real Estate Estates

The Villages Fl Cost Of Living How Much Does It Cost To Live In The Villages In Florida Data Tips

Florida Income Tax Calculator Smartasset

Florida Property Tax H R Block

Guide To The Florida Squatter Law Remax Infinity Property Management

Florida Attorney For Federal Estate Taxes Karp Law Firm

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Dept Of Revenue Florida Sales And Use Tax

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

Buyer S Guide To Closing Cost Realtor Realestate Closingcosts Homebuying Home Newhome Home Buying Checklist Real Estate Buyers Real Estate Education

What Is Florida County Tangible Personal Property Tax

Florida Retirement Tax Friendliness Smartasset

Florida Probate Rules Processes What You Need To Know

Florida Homestead Exemption How It Works Kin Insurance