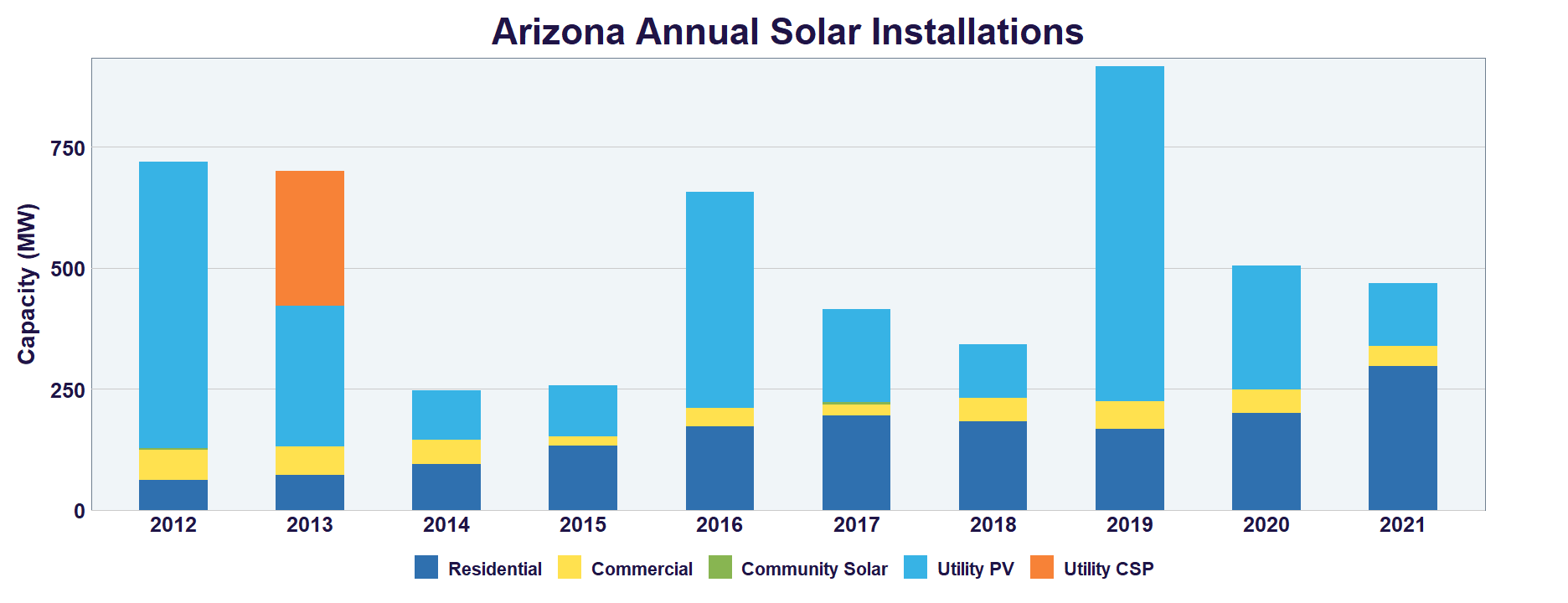

arizona solar tax credit 2022

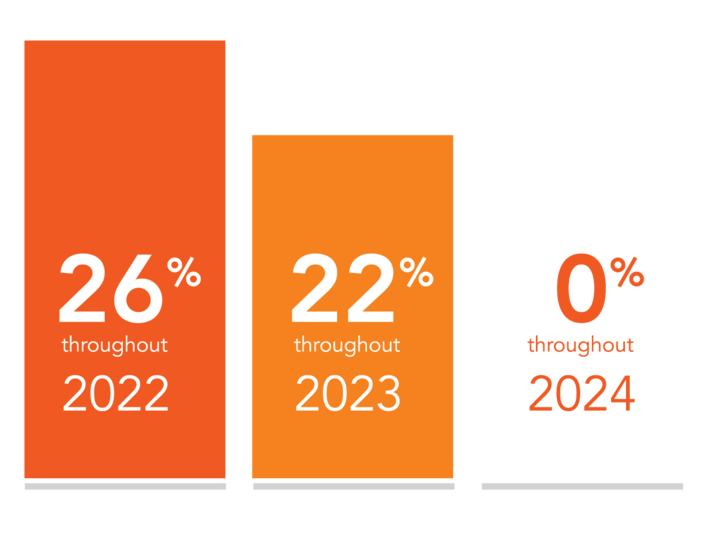

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. The federal tax credit falls to 22 at the end of 2022.

Falsecolor Image Of Saturns Rings In 2022 Astronomy Planetary Space Photos

What is the solar tax credit for 2022.

. Ad Learn How To Leverage Available Solar Incentives To Maximize Your Solar PV System. In 2023 it drops down to 22 before ending permanently for homeowners beginning on January 1 2024. Leverage Limited-Time Solar Incentives To Maximize Your Investment.

The Arizona Department of Revenue is advising homeowners who installed a solar energy device in their residential home during 2021 to submit Form 310 Credit for Solar Energy. The Arizona state tax credit is 25 of your solar PV system costs up to 1000. Enter Your Zip Find Out How Much You Might Save.

The federal tax credit will remain at 26 until the end of. Ad Find The Best Solar Providers In Arizona. Ad Option One Solar The Best High Desert Solar Installation Company.

A nonrefundable individual tax credit. If you use solar to heat your home or water heater instead of. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

Ad Find The Best Solar Providers In Arizona. See Ratings Compare. Enter Your Zip Find Out How Much You Might Save.

The solar energy systems that qualify for a 26 tax credit must be placed into service by December 31 2022. The Arizona state tax credit is 25 of your solar. See Ratings Compare.

Leverage Limited-Time Solar Incentives To Maximize Your Investment. 1000 Arizona Solar Tax. 23 rows Credit for Solar Energy Devices.

Most Arizona residents are eligible to receive the Federal Solar Investment Tax Credit also called the Solar ITC. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. This benefit allows eligible homeowners to reduce the amount of tax they owe by.

Income tax credits are equal to 30 or 35 of the investment amount. Ad Learn How To Leverage Available Solar Incentives To Maximize Your Solar PV System. Over 50 Years of Experience with The Best Review to Serve Local Families Businesses.

Premium Service - We Have 1000s of Contractors Nationwide Ready To Service Your Project. 5 rows What is the solar tax credit for 2022. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

Ad 2022 Discounts Available - Shop Deals To Get The Best Price On Solar - Only Takes 1 Minute. The 26 solar tax credit is available through the year 2022. The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program.

California Solar Incentives And Rebates Available In 2022

Get Multiple Quotes In 2022 Solar Companies Quotes Solar Energy

Federal Solar Tax Credit 2022 How It Works How Much It Saves

High Voltage Power Lines Arizona Usa Black And White Pictures High Voltage Black And White

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Solar Tax Exemptions Sales Tax And Property Tax 2022

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Solar Tax Credit Details H R Block

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Solar Tax Credit California Sky Power Solar San Ramon Tri Valley Ca

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania

Nickel Nickel Nickel Diving Into Green Nickel With Talon Metals Nickel Fleet Diving

Making Home Repairs The Right Credit Card Could Make A Huge Difference A 21 Shabby Chic Bathroom Decor Shabby Chic Bathroom Accessories Shabby Chic Bathroom

How Green Is Your State Vivid Maps Nuclear Energy United States Map Map